3. Impact Investing – Thinking Differently

Whether you have an existing endowment or are just starting to build one, an important consideration for the Board is whether those charitable dollars are – or will be – invested to advance your organization’s mission. Developing your investment strategy represents an extremely valuable opportunity to further your impact and achieve your vision for systemic change – one that should not be overlooked or delegated without thoughtful discussion.

In Topic #5 we discuss the laws around nonprofit investing and spending and in Topic #6, we walk you through defining your values and developing your investment policy statement. But first, let’s talk about investing charitable dollars generally and the concept of “impact investing”.

Shifting Perspectives on Charitable Investing

Traditionally, most organizations have taken an investment and spending approach that will comfortably satisfy their legal requirements (see Topic #5) and their fiduciary duties (see Topic #1) without spending much time considering whether that approach is making the most of their charitable dollars.

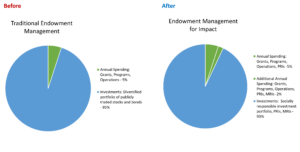

In practice, this means that Boards allot 5% of their nonprofit’s assets annually – and maybe less if they are not private foundations – for spending on charitable grants, programs, and operating expenses in furtherance of their mission. They invest the other 95% of the nonprofit’s assets in a diversified portfolio of publicly traded stocks and bonds producing market rate returns. Boards following this investment approach can be comfortable that the approach satisfies the legal prudence standard, their fiduciary duty of care, and the annual 5% federal pay-out requirement if they are a private foundation.

However, many organizations are now looking beyond the traditional investment approach and are seeking to make the most of their endowment by investing for impact. In practice, this means taking advantage of a variety of opportunities such as increasing their annual spending – say from a 5% minimum for a private foundation to 6% or 7% – and rebalancing their endowment portfolio (the “other” 93% to 95% of assets) to include investments that further their charitable missions. These organizations – complying with legal rules and guidance – have adopted an impact investment approach that aligns spending and investing decisions with the organization’s values and mission – all while achieving healthy investment returns.

Impact Investing

The term “impact investing,” sometimes referred to as “values-aligned investing,” is a helpful catch-all term that describes investment approaches that are socially responsible and mission-driven. There are two main strategies nonprofits use – either separately or together – and they are called socially responsible investing and mission-aligned investing.

Socially responsible investing (SRI), sometimes called “socially conscious investing” or “sustainable and responsible investing,” is a strategy that seeks to integrate a nonprofit’s values into its investment portfolio by adding or divesting from specific companies. In other words, using SRI, a nonprofit can exclusively include in its investment portfolio companies that are values-aligned with the organization’s mission, or it can exclude from its portfolio companies that are not aligned with the mission.

Common examples of investments that might be excluded from a nonprofit’s socially responsible portfolio are tobacco, fossil fuels, weapons or firearms, and gambling. SRI is generally carried out at the direction of the Board by the nonprofit’s investment advisors pursuant to the organization’s investment policy statement.

Environmental, social, and governance-investing (ESG), is another strategy for nonprofits to integrate their values into their investment portfolios. ESG looks at performance metrics for companies’ environmental, social, and governance policies and procedures. A nonprofit can use those ESG metrics to evaluate whether its investment in a particular company aligns with the nonprofit’s values. Examples of ESG metrics might include looking at a company’s carbon emissions, supply chain labor standards, business ethics, and Board diversity. A mission-minded investment advisor can help apply ESG to the nonprofit’s portfolio.

Mission-aligned investing, also called “mission-related investing” and sometimes used interchangeably with “impact investing,” is another investment strategy. Like SRI, mission-aligned investing uses investment portfolio funds not only for a financial return and long-term sustainability, but also to create a more positive charitable, social, or environmental impact.

Unlike SRI, mission-aligned investing is carried out in a more specifically targeted and involved way, generally involving the nonprofit’s staff and legal advisors, typically by using tools such as program-related investments (PRIs) or mission-related investments (MRIs).

The range and variation of mission-aligned investments is broad. They can be similar to grants or more entrepreneurial in nature. They can be low-risk or high-risk and range from little (or no) return to a high rate of return. They can be for shorter or longer periods of time, and they can be made directly (sometimes in collaboration with funding partners) to nonprofits or to for-profits.

So long as the purpose of the investment aligns with an organization’s mission, the Board has a robust menu of options to select from when it comes to impact investing. See below for some examples of mission-aligned investments, or for more information on PRIs, MRIs, their similarities and differences, download our Impact Investing Board Discussion Guide.

Read on to Topic #4 where we share some specific impact investing activity suggestions for nonprofits seeking to maximize their charitable dollars to achieve greater impact.

EXAMPLES OF MISSION-ALIGNED INVESTMENTS FROM THE TREASURY REGULATIONS

Below are a few examples of mission-aligned investments, which come from the Internal Revenue Code’s Treasury Regulations (see Title 26 of the Code of Federal Regulations, Section 53.4944-3(b) for more examples). For private foundations, each of these examples, with proper structuring, can qualify as a program-related investment for purposes of meeting the 5% annual pay-out requirement.

- Making a loan at a below-market rate to a small business located in a distressed urban area and owned by a member of an economically disadvantaged group to encourage economic development of the community. Or, instead of a loan, purchasing shares of the small business’s common stock to increase its equity capital and improve its opportunities for receiving funding from conventional sources at reasonable interest rates.

- Making a below-market loan to a business in a distressed urban area that is important to the community and that employs a substantial number of community members but is unable to obtain funding from conventional sources at reasonable rates. Or making a similar loan to a successful, for-profit company to induce the company to establish a business in a distressed area – such as a grocery store in a food desert.

- Making a high-risk investment to finance the purchase, rehabilitation, and construction of low-income housing with the debt insured by the Federal Housing Administration.

- Guaranteeing a loan from a conventional lender to a nonprofit that provides childcare services in a low-income neighborhood and wants to construct a larger facility to reduce the number of children on the waiting list and serve more families.

WANT SOME EXAMPLES OF AN IMPACT INVESTING APPROACH?

Watch the Ford Foundation’s video on how it is using its endowment to reduce inequality or another video on how the Foundation uses PRIs. Or watch the Untours Foundation video “Dollars That Make Sense”.